Dividends can be an important component of investment returns over the long term. They are often more stable than stock price performance and can help buoy a portfolio in years when market returns are negative. When a company can consistently increase its dividend over a longer period of time, it is often a signal the business is able to profit through different market environments.

While there are many excellent dividend-paying companies located here in Canada, our relatively small population, and market size, means that most of the world’s best investment opportunities are located outside of our borders.

Why Mackenzie Global Dividend Fund and ETF

The fund and ETF seek to achieve solid long-term growth and mitigate volatility.

Durable growth through time:

The fund and ETF are constructed with high-quality companies in stable industries that have a lower risk of disruption from outside forces. These companies will generally have a competitive advantage over their industry peers that makes their operations and profit margins more durable through time. Owning stable companies could lead to less volatility as you accumulate wealth.

Grow your wealth with the power of dividends:

The fund and ETF invest in companies with a track record of generating strong returns on invested capital, a measurement of their profitability and ability to create value. These companies, while highly profitable, are generally not highly capital-intensive and can therefore return some of these profits to shareholders in the form of a dividend. And, as these companies reinvest some of these profits back into their operations, they will often increase their dividends to shareholders.

How it works

Identifies industry leaders:

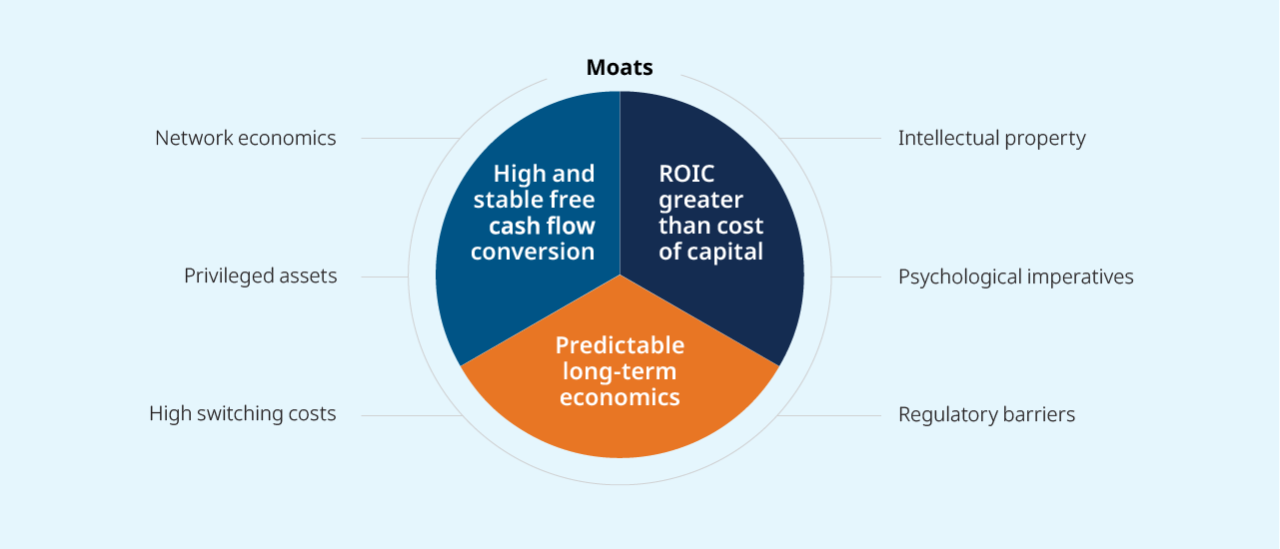

The team searches around the world to find industry leading companies that have a competitive advantage, or protective “moat”, that make the economics of their business operations more predictable and durable. Moats come in many forms, each providing the company with a distinct edge over their peers.

Nimble when opportunities arise:

A strong sense of curiosity combined with decades of diligent and detailed research has led to a defined watch list of high quality dividend-paying companies. By maintaining a focused list of industry-leading businesses around the world, the team is able to act quickly when the market environment changes, and the share price of these industry-leaders falls below what the team believes they are worth.

Why invest with Mackenzie

As a Canadian-owned global asset management provider, we’ve been helping advisors deliver the best possible advice and investment solutions for more than 50 years. With over $200 billion in assets under management and a comprehensive line of investment solutions, we are one of Canada’s leading asset management companies. Our journey began with one client and one advisor working together, and though we’ve grown, we remain committed to the same belief, advice matters. When we work together with advisors and investors, we can achieve better financial outcomes.

To learn how the Mackenzie Global Dividend Fund and Mackenzie Global Dividend ETF can help you achieve your financial goals, speak to your investment advisor today.

Commissions, management fees, brokerage fees and expenses all may be associated with Mutual Funds and Exchange Traded Funds. Please read the prospectus before investing. Mutual Funds and Exchange Traded Funds are not guaranteed, their values change frequently and past performance may not be repeated. The content of this collateral (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.